Farmers & Merchants State Bank

Updated Thu October 9, 2025

Published Under: Financial Planning General Lake Mills

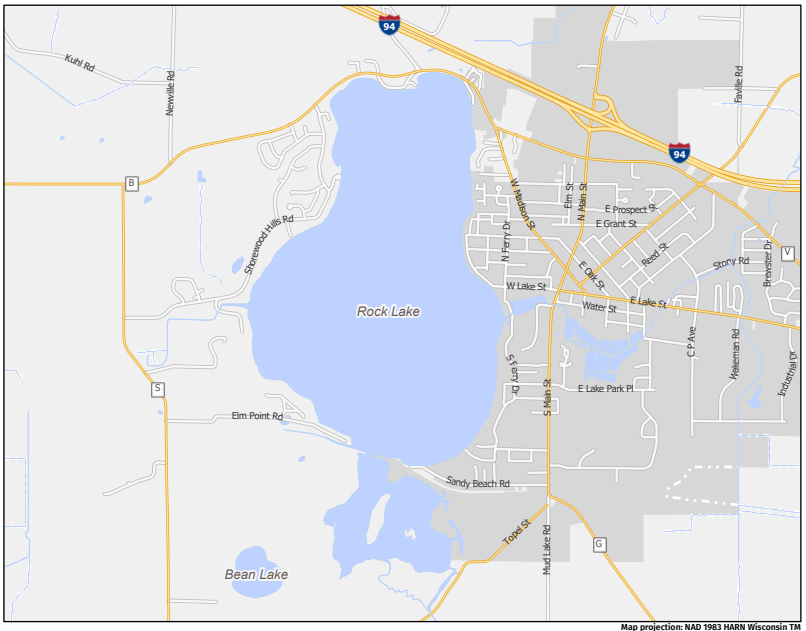

Nestled in the heart of Lake Mills, Wisconsin, Rock Lake has long been the subject of local lore. Some believe there are ancient pyramids hidden beneath its waters, structures credited to Native communities, Aztecs, railroad workers, or even Atlantis itself. Whether myth or misunderstood geology, these underwater mysteries have fueled curiosity for generations.

But here’s the twist: those pyramids can also teach us something practical, and it's how to build a financial future that stands the test of time.

At Farmers & Merchants State Bank, we love connecting local legends to everyday lessons. Let’s bust a few financial myths and talk about how to create a foundation that’s stronger than stone.

Quick Navigation

- The Legend of Rock Lake’s Pyramids

- Myth #1: Pyramid Schemes Are a Legit Way to Build Wealth

- Myth #2: Compound Interest Is a “Magic Pyramid” That Works Overnight

- Myth #3: You Need Monumental Income to Build a Strong Financial Foundation

- Lessons from the Lake

- Ready to Build Your Future?

The Legend of Rock Lake’s Pyramids

The stories began in the early 1900s when divers reported spotting stone structures with pyramid-like shapes beneath Rock Lake. Some believe they were built by the Aztalan people, whose ancient earthworks can still be seen at Aztalan State Park, just a few miles away.

Others suggest the pyramids are remnants of railroad construction, or even natural rock formations mistaken for human-made structures. A few theories go further, linking them to the myth of Atlantis or claiming they are burial mounds lost to rising waters.

To this day, no definitive proof has solved the mystery, which makes Rock Lake’s pyramids one of Wisconsin’s most intriguing local legends. And just like finances, it reminds us: things aren't always what they seem on the surface.

Myth #1: Pyramid Schemes Are a Real Way to Build Wealth

Just like the elusive Rock Lake pyramids, pyramid schemes sound mysterious and exciting at first glance. They promise fast returns and easy money, but the truth is, they’re a trap.

Reality: Pyramid schemes are illegal and unsustainable. Instead of offering a real product or service, they rely on recruiting new people. Eventually, the whole structure collapses, leaving most people with losses, not gains.

3 Red Flags of a Pyramid Scheme:

- Promises of fast, guaranteed returns

- Focus on recruiting over selling a product

- Pressure to “get in early before it’s too late”

Your Better Option: Stick with transparent, ethical banking. If an opportunity sounds too good to be true, it probably is. Our team at F&M can help you separate scams from smart choices. F&M Bank also offers transparent savings accounts, CDs, and other safe options designed to help your money grow, no gimmicks attached.

Myth #2: Compound Interest Is a “Magic Pyramid” That Works Overnight

Compound interest is often described as a financial “miracle.” And it really is powerful. But it’s not a lottery ticket.

Reality: Compound interest works over time, like laying stones one by one until you’ve built something strong. The earlier you start saving, the more your money has time to grow.

Example: If you save $50/month starting at age 20, you’ll have nearly $100,000 by age 65 (assuming a modest 6% return). Start at 35, and you’ll end up with about half that. Time matters!

Your Better Option:

- Start small. Open a Youth Savings Account for your child to teach them early.

- Use a Certificate of Deposit (CD) for long-term savings you don’t need right away.

- Ask our team to walk you through our compound interest calculator so you can see your own numbers.

Learn More About Certificates of Deposit

Myth #3: You Need Monumental Income to Build a Strong Financial Foundation

It’s easy to believe financial stability is reserved for the wealthy. But like the Rock Lake pyramids, if they exist, strong structures aren’t built overnight, and they weren’t reserved for kings.

Reality: You don’t need a giant income; you need a plan.

3 Small Steps That Build a Strong Foundation

- Budget: Track your money with simple tools (or even pen and paper).

- Save: Aim for $10–$20 a week in a savings account. It adds up fast.

- Set goals: Whether it’s a down payment, college fund, or emergency savings, having a target keeps you focused.

Your Better Option: Our F&M team can help you build your financial pyramid brick by brick, with personalized advice and local support. Visit one of our branches – our Lake Mills one is not a myth, we promise!

Did You Know?

-

Rock Lake is over 60 feet deep in some spots.

-

Legends say as many as 12 pyramids lie beneath the water.

-

Aztalan State Park, just down the road, is home to preserved prehistoric earthworks built around 900 AD.

Lessons from the Lake

Whether Rock Lake’s pyramids are ancient architecture, natural formations, or just the stuff of small-town storytelling, they remind us of this: always look beneath the surface.

Financial myths can sound convincing, just like folklore. But building your money future on solid ground means questioning, planning, and choosing trustworthy partners.

At Farmers & Merchants State Bank, we’re proud to serve Lake Mills, Waterloo, and Marshall with:

- Honest guidance (no gimmicks, no scams)

- Secure banking tools

- Local people who care about your success

Ready to Build Your Future?

Let’s leave the mysteries for Rock Lake. When it comes to your finances, clarity and trust are the foundation.

Visit us at fandmstbk.com or stop by your local branch. Together, we’ll uncover the truth and build something lasting.

Comments